In a perfect world, students would be able to stack all of the scholarships or grants they receive on top of any institutional scholarships provided by their school. Unfortunately, this isn’t always the case. Let’s define the basics of scholarship displacement and how to help mitigate its effects on your education.

What is scholarship displacement and when does it occur?

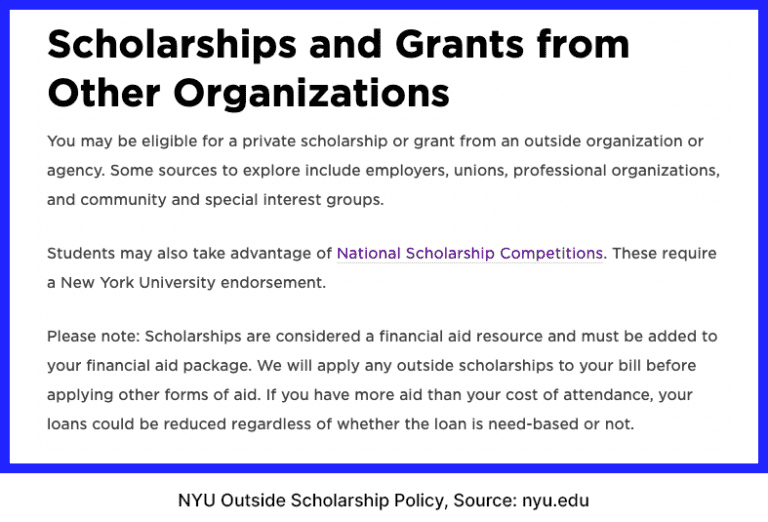

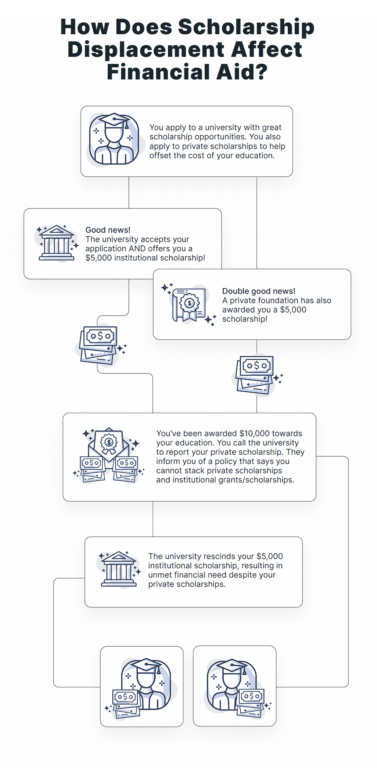

In some cases, when a student notifies their school of a private scholarship they’ve been awarded, the school will reduce previously awarded institutional scholarships or grants. This process is called scholarship displacement. It offsets the financial benefits of receiving a private scholarship by enforcing Expected Family Contribution.

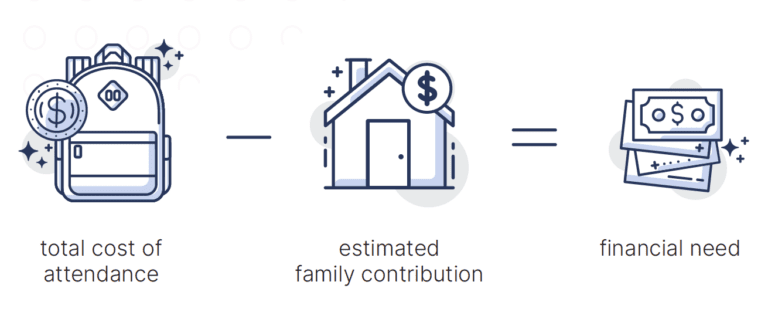

How is financial need determined?

When you submit the FAFSA, you and your family’s financial information is used to calculate your Expected Family Contribution (EFC). Financial Need is then determined by subtracting your EFC from the overall cost of attendance.

In most cases, students can find out before applying whether their college practices scholarship displacement. The school’s policies may be accessible through their website, usually in a section that discusses their financial aid. You can also contact the financial aid office directly for more information.

Why should I be aware of scholarship displacement?

Scholarship displacement hinders equity in education. It forces low-income individuals to compensate for displaced financial aid with loans or work. The added financial burden on these students impacts their likelihood of graduation. It also negates the time and effort they have put into applying for scholarships. Scholarship displacement encourages a system where the burden of paying for education falls on the private sector, rather than being a shared effort between institutions and communities.

How do I protect myself from scholarship displacement?

Before you commit to a school, here are a few things you can do to help mitigate the likelihood of scholarship displacement.

- Talk to your financial aid office. Determine whether your loans or work study programs will be affected before you accept any scholarship opportunities.

- Talk with your scholarship provider. Your scholarship provider might allow you to defer your award for a semester, a year, or even after graduation so you can apply it to your student loan payments.

- Champion change. Calls from advocacy groups and students like you have helped legislators become aware of the problem and have encouraged them to take action.

In 2017, Maryland became the first state to ban displacement by public colleges. Since then, other state legislatures and Congress have also introduced legislation to curb this practice. These efforts promote transparency about the cost of higher education.

When in doubt, your school’s financial aid office will be your go-to place for answers regarding all of the financial aspects of your education. Don’t hesitate to reach out to them when you are unclear about anything financially related to your college experience. Want a printable copy of this scholarship guide? Download it here.

Want to start applying for scholarships? Create a free profile on Kaleidoscope here.